By Jack Nicklaus Tunge, CFP®, CRPC®

It’s quite simple really. A CERTIFIED FINANCIAL PLANNER™ provides financial advice that focuses on all facets of your financial life. We are driven by formulating plans and strategies that make you successful.

Today, I wanted to share ONE brief example of the value a financial planner adds to his/her clients. Or at least he or she should be adding!

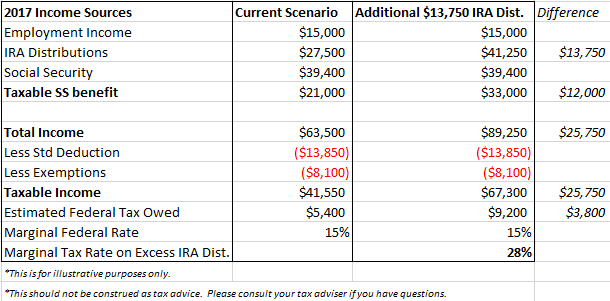

A client of mine, Deborah (not her real name), came to me earlier this week and asked to withdraw a sum of money from her pre-tax IRA to pay for a new roof on her house. Knowing that she has monthly withdrawals already in place, I kindly asked her to give me a few days to run some analyses to see the potential tax consequences of the additional lump sum distribution, and to confirm whether or not this is the best resource to use for the roof. The chart below illustrates the two scenarios and the tax consequence of the additional income.

At first, it would appear withdrawing an extra $13,750 from her IRA would not bump her into a higher federal tax bracket (the 15% bracket for MFJ is between $18,651 – $75,900 in taxable income). And, in fact, that is correct. However, federal tax rates are not the only tax considerations for retirees. An additional $13,750 IRA distribution would increase her taxable Social Security benefit and overall taxable income. She would potentially pay an extra $3,800 in taxes to take out $13,750 from her IRA. That’s a 28% marginal tax hit on the distribution! Needless to say, a home equity line with a 4% interest rate paid off the following tax year is a much better option, within her means and will save her thousands of dollars. Oh, and did I mention the interest is tax deductible for someone that itemizes deductions?

Does your current broker or adviser provide this kind of in-depth analysis for you? Do they provide advice on which accounts to pull income from in retirement and what order (pre-tax, taxable, Roth, etc.)? Which accounts do you tap first and how much from each? When and how is the best time to file for Social Security based on your personal situation? How much will taxes take? How much risk in your investment portfolio is optimal given the income you desire? These are all questions that should be answered before you retire.

There are lots of considerations, in addition to taxes, that play a very important role for someone who is in, or near, their golden years. At Midwest Capital Advisors, we partner with our clients to provide advice above and beyond investments. If you are near or in retirement, then you have probably outgrown your broker or adviser who ONLY manages your investments. Give one of our CERTIFIED FINANCIAL PLANNER™ professionals a call to see what a true financial partner can do for you.

The team at Midwest Capital Advisors wants our clients to make smart financial decisions. Wise choices are easier when you are well-informed. This article will hopefully enhance your general understanding of current issues related to financial and/or investment planning. The information may or may not pertain to or be appropriate for your particular financial situation. We are here to help you discern what is right for you, so please contact us with any questions. We also encourage you to visit our website to learn more about our services.

Material in this newsletter is original or from published sources, and it is believed to be accurate. However, we do not guarantee the accuracy or timeliness of such information and assume no liability for any resulting damages. All expressions of opinion reflect the author’s judgment at the date of publication and are subject to change without notice in reaction to changing market conditions. The views expressed are those of the author and do not necessarily reflect those of Midwest Capital Advisors, LLC. This material is provided for general informational purposes only, and it is not to be construed as investment or financial advice or an offer, solicitation, recommendation or endorsement of any particular security, product or service. Readers are urged to consult their own tax and investment professionals with regard to their specific situations.