2022 has been a year of volatility with both domestic issues and foreign affairs causing major swings in the equity and bond markets. As of August 1, the S&P 500 is down -12.58% YTD and the Bloomberg US Aggregate Bond Index is down -8.16%.[1] Declines like these can be discouraging, but down markets also present opportunities for the savvy investor. These include Roth conversions, tax loss harvesting, buying at a discount, and staying the course. These strategies are best utilized with the advice of a financial professional.

[1] https://am.jpmorgan.com/content/dam/jpm-am-aem/americas/us/en/insights/market-insights/wmr/weekly_market_recap.pdf

Roth Conversions

Roth Conversions are a strategy where an investor converts a portion of his/her traditional (tax-deferred) IRA into a Roth IRA. A conversion is a taxable event to the investor but unlike a normal distribution, is not subject to age restrictions[1]. By choosing to convert a portion of their traditional IRA, the investor will pay taxes on the amount converted at their current tax rate in the year of conversion. All future appreciation of the securities converted to the Roth IRA grows tax-free instead of tax-deferred, thus the true benefit of this strategy. For example, consider Jeff has an IRA that has seen a 15% decline due to overall market volatility, and he decides to convert $40,000 worth of securities from his Traditional IRA into his Roth IRA. In the future, when the market recovers and the shares appreciate, the 15% that declined in the traditional IRA will now grow tax-free in the Roth IRA along with all future growth. Roth conversions can be utilized at any point in the economic cycle but they can have an outsized benefit in times of market decline.

[1] IRA distributions prior to age 59.5 are subject to a 10% early withdrawal penalty. In order for a Roth IRA’s growth to be tax-free, the account must be funded for 5 years.

Tax-Loss Harvesting

Tax-loss harvesting allows investors to realize capital losses when their portfolios are down without being out of the market. According to the Internal Revenue Code, an investor can offset capital gains dollar for dollar with capital losses. Investors can also deduct up to $3,000 of capital loss from earned income each year. For example, say an investor has losses in a nonqualified (non-retirement) account in 2022. The investor would sell those securities and realize the capital loss and then immediately purchase other securities that are similar, but not substantially identical. After the wash sale holding period (30 days) the investor could buy back into the original security. In short, this strategy can allow the investor to lower their tax burden while staying invested.

Buying at a Discount

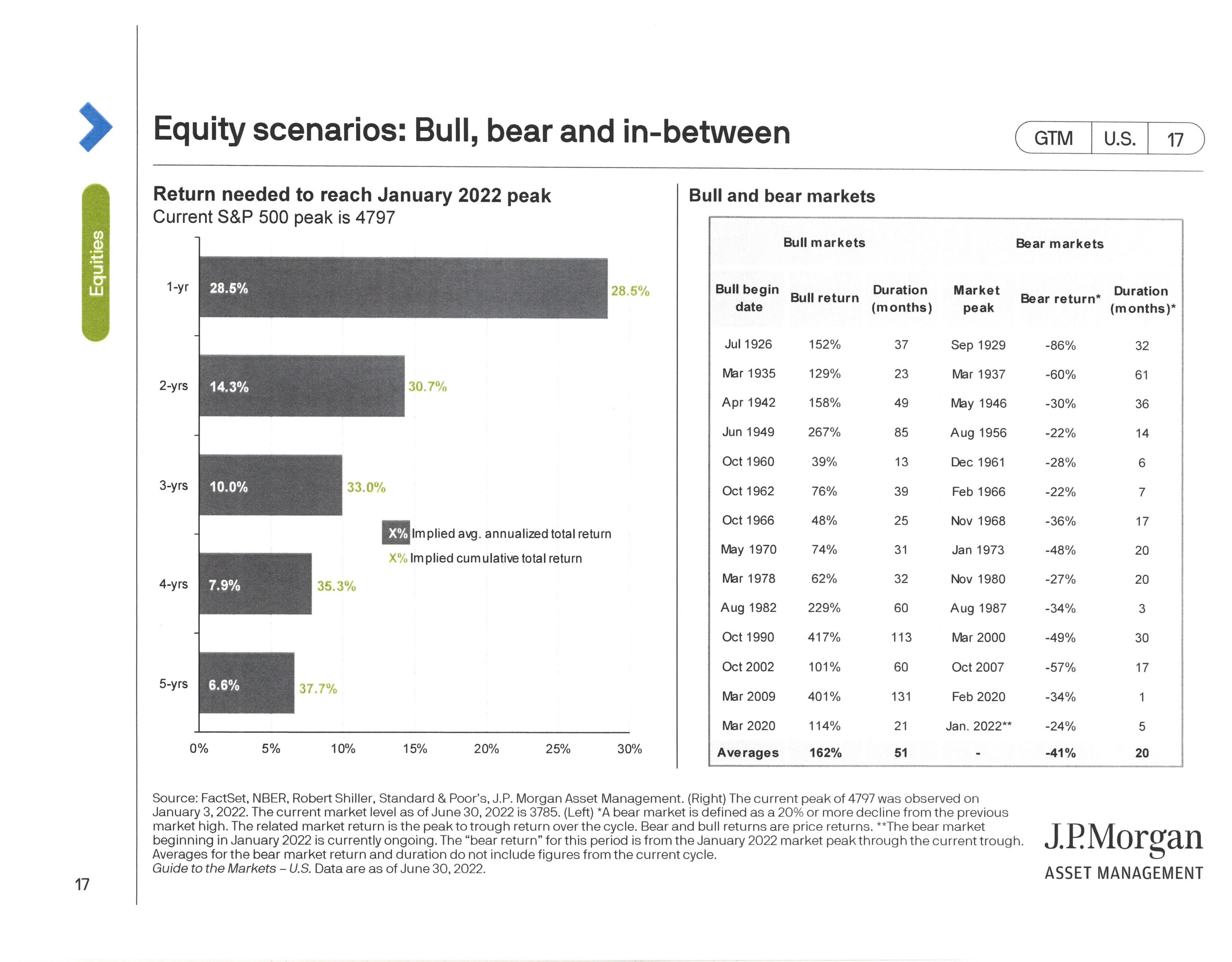

While down markets can be discouraging and the fear of further losses can be at the top of an investor’s mind, an often beneficial time to invest is when markets have declined. With the S&P 500 down almost 15%, an investor with cash available could invest at an almost 15% discount relative to valuations at the beginning of the year. History tells us that markets eventually recover; the average bull market lasts 4.25 years and the average bear market lasts just 1.6 years. No one knows if the market will continue to trend downward or begin to recover but buying “low” can offer long-term investors the chance for better future returns.

Sticking with Your Plan

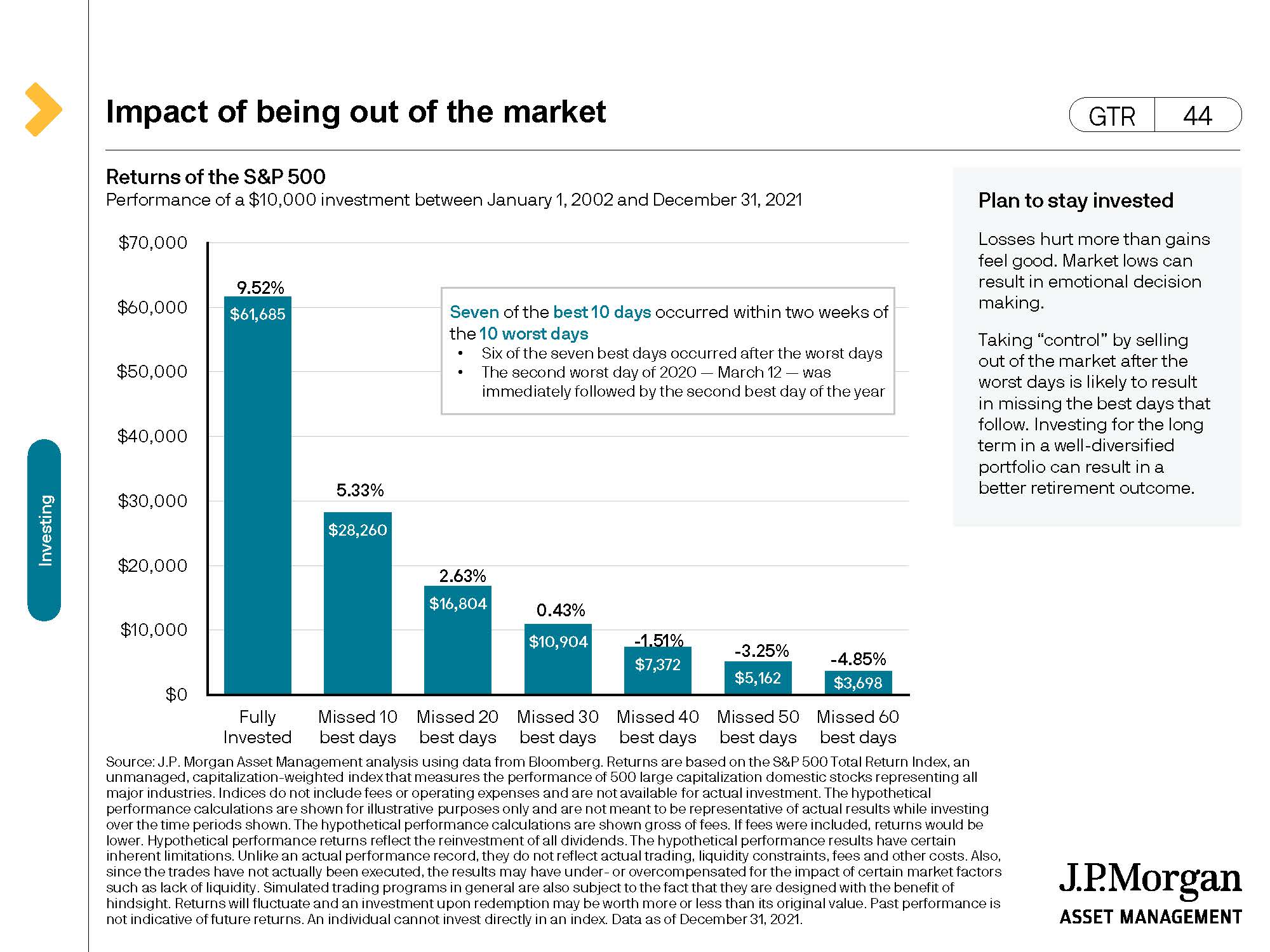

One of the most important things to do during times of volatility is to stick with your plan. A well-crafted financial plan should help ease the emotions of investors when markets are down. For example, when an investor sees their portfolio decline, some may (understandably) get nervous. If one does not have a financial plan, or even if they do, there will be a temptation to make decisions based on emotion, which can lead to bad outcomes for investors. This is why we encourage our clients to sit down and review their financial plans. Historically, being out of the market, even for just 10 days, can severely impact your returns and in turn, your financial future. As you see below, missing out on market upswings can severely impact your return. A financial plan does not time the market, rather it puts an investor on the right path and keeps them on it regardless of the market forces swirling around it.

Plan for a More Confident Financial Future

These are just a few of the many strategies that can be employed during periods of market volatility. Not all strategies make sense for everyone as their effectiveness and suitability are highly dependent on your individual situation. If you are interested in creating a financial plan and exploring how these strategies could fit, please contact us!

Disclosure: Please note that you are advised to consult your tax professional for your individual tax situation. This information is designed to provide general information on the subject(s) covered and is not intended to be tax advice. This information cannot be used to avoid tax penalties or provide recommendations for any tax plan or arrangement.