Financial markets do not like bad news, and the current COVID-19 outbreak is no exception. While many investors are tempted to “do something” in times of volatile markets, the best move for long-term investors is often no move at all.

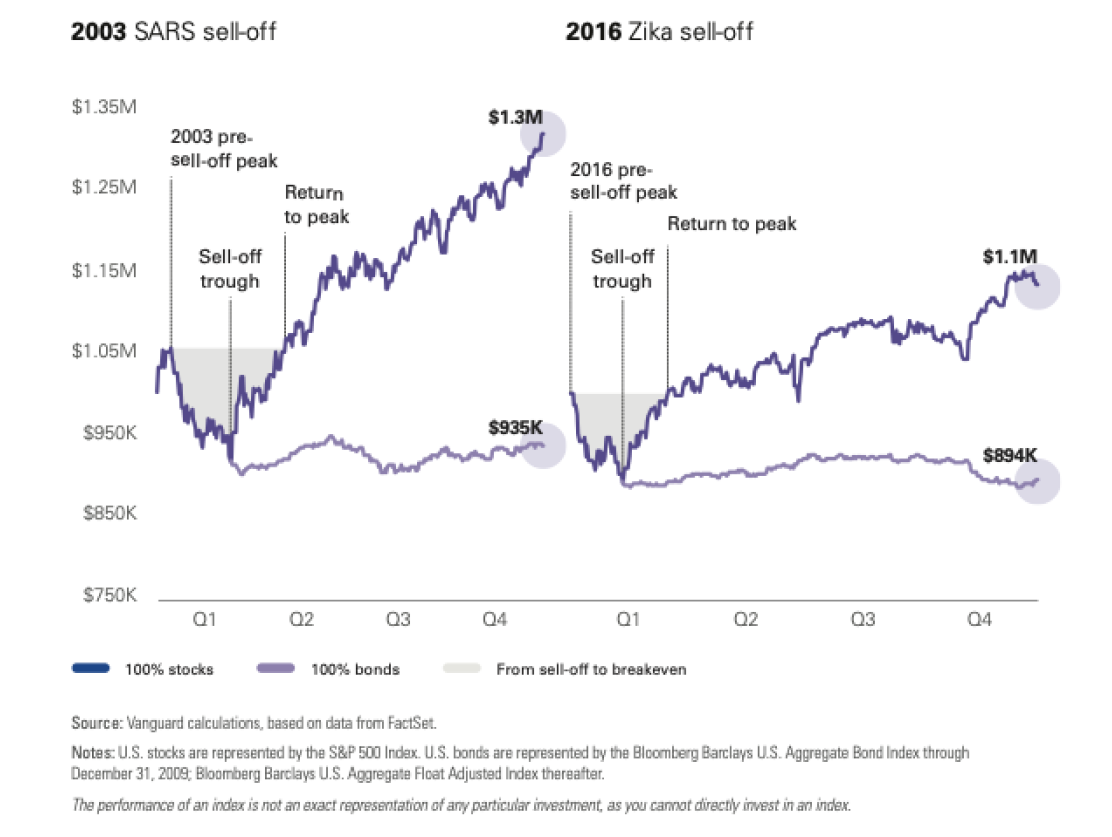

Market uncertainty is being felt around the globe, and it is unsettling on a human level as well as from the perspective of how markets are responding. A core belief here at MCA is that markets and our clients’ portfolios are designed to handle uncertainty. We see this happening when markets decline sharply, as they have recently, as well as when they rise. Such declines can be unnerving and distressing to any investor, even those that have a solid financial plan in place. At the same time, the declines demonstrate that the market is functioning as we would expect. For example, let’s look at the relationship between stocks and bonds. In diversified portfolios we hold bonds as a “buffer,” specifically to help when markets see an increase in volatility. And, while equity markets are down year-to-date, as of March 9th, the Bloomberg Barclays US Aggregate Bond Index (our intermediate-term bond proxy) is up 5.71%.

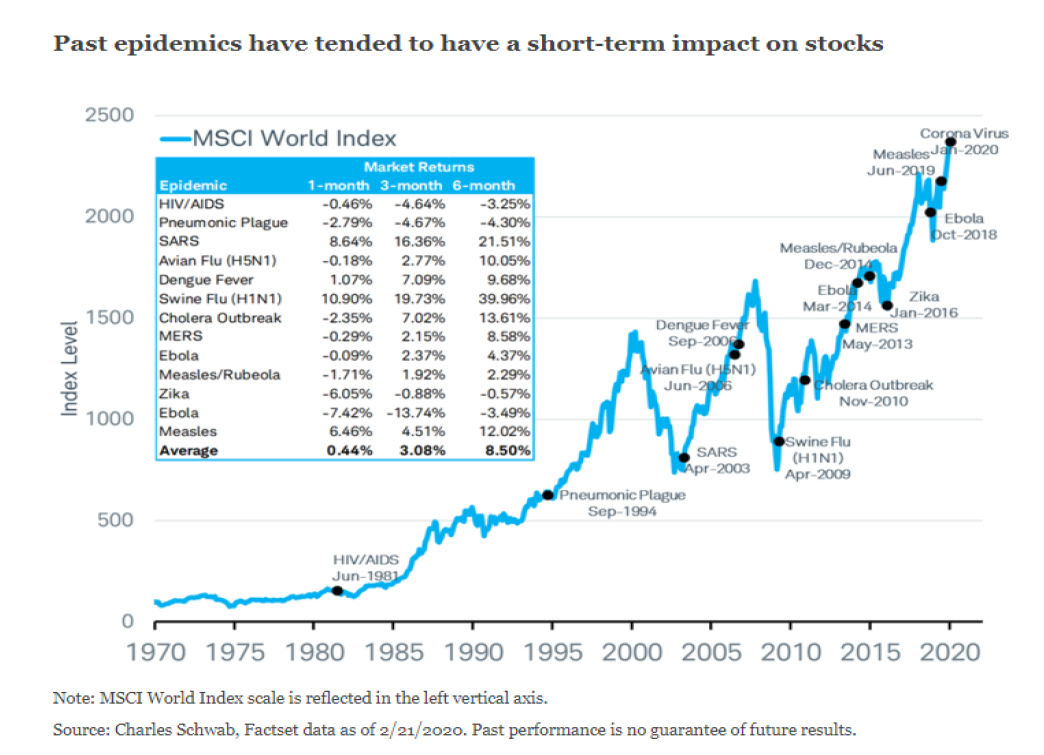

We understand that situations like these can be foreboding, especially when we don’t know how long they will last. We cannot tell you (no one can, at least with any degree of certainty) when things will turn or by how much, but our expectation is that bearing today’s (and tomorrow’s) risk will be compensated with positive expected returns. That’s been a lesson not only of past health crises (see charts below) but also events such as the global financial crisis of 2008-2009.

Additionally, history has shown no reliable way to identify a market peak or bottom. There are numerous studies (many of which we have referenced in prior quarterly letters) that illustrate how missing out on the best-performing days in the market – regardless of when the bad days are – can wreak havoc on your long-term returns. To us, these facts argue against making market moves based on fear or speculation, even as difficult and traumatic events unfold.

Volatility is a normal (albeit unpleasant) part of investing. We all know that markets go up and down and, while we can be disappointed and unnerved by downturns, we should not be surprised by them. Most importantly, for long-term investors, reacting emotionally to market volatility, even when it is as high as it has been lately, may be more detrimental to portfolio performance than the draw-down itself.

We continue to monitor and track the current pandemic closely and will continue to keep you informed. As always, we encourage you to contact us if you have concerns or questions about current market conditions or how your retirement portfolio is designed to withstand them.