Written by Jack Tunge, CFP®, CRPC®

Under the new tax law, many itemized deductions have been eliminated while the standard deduction has basically doubled. Because a charitable contribution is an itemized deduction, most people will no longer receive the full deduction value unless the total of all their itemized deductions is greater than the standard deduction ($24,000 for MFJ, $12,000 for single taxpayers).

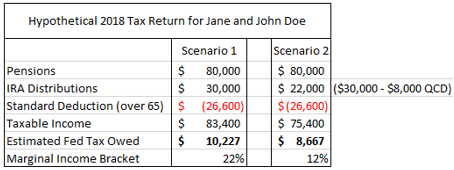

Let’s look at an example. (For simplicity’s sake, there are no Social Security benefits as to avoid the “how Social Security is taxed” discussion.) John and Jane Doe each have a $40,000 annual pension. Their total required minimum distribution (RMD) for 2018 is $30,000, which is based on their pre-tax account balances. If John and Jane would like to donate $8,000 to a charity using cash or appreciated stock but only have an additional $6,000 in itemized deductions ($14,000 total) they will simply use the standard deduction ($26,600 for those above 65) for the year because it is much higher. Moreover, this means regardless of their charitable donation, they would still be entitled to use the full $26,600 standard deduction. The tax deduction might not be the primary driver of the donation, but what if I told you there were a way to get the full tax benefit and meet your charitable goals?

Qualified Charitable Distributions (QCDs) allow an IRA owner over the age of 70.5 to donate up to $100,000 annually to a charity tax-free. A QCD is removed from your total IRA distribution thereby moving your charitable contribution “above-the-line” from what would otherwise be a “below-the-line” deduction. The illustration shows how using a QCD to donate directly to a charity reduces your IRA distribution and provides a more favorable way to donate to charity under the new tax law. In fact, even if John used a highly appreciated stock that he purchased years ago for $1,000 and is now valued at $8,000, he is better off using the QCD approach. If he used the stock, he would be saving $1,050 ($7,000 x 15%) in capital gains tax. However, that is still less than the $1,560 ($10,227-$8,667) in tax savings he receives by giving directly from his IRA.

A few intricacies on QCDs:

Distributions must go directly to a qualified charity via trustee transfer OR the check must be made payable to the charity and NOT the IRA owner.

Donor-advised funds and private foundations do not qualify.

The annual limit is $100,000 per spouse.

QCDs may satisfy an annual RMD.

Be sure to discuss the QCD process with your IRA custodian and/or financial planner.

There is not currently any special coding on the 1099-R that will be generated by taking a distribution from an IRA. Please make sure your tax adviser is aware of any QCDs.

If you are unsure what the most tax-efficient way for you to donate to charity may be, please give me a call at 616-454-9600 or contact email me at jtunge@midwestcap.com.

Material in this publication is original or from published sources, and it is believed to be accurate. However, we do not guarantee the accuracy or timeliness of such information and assume no liability for any resulting damages. All expressions of opinion reflect the author’s judgment at the date of publication and are subject to change without notice in reaction to changing market conditions. The views expressed are those of the author and do not necessarily reflect those of Midwest Capital Advisors, LLC. This material is provided for general informational purposes only, and it is not to be construed as investment or financial advice or an offer, solicitation, recommendation or endorsement of any particular security, product or service. Readers are cautioned to consult their own tax and investment professionals with regard to their specific situations.