By Jack Nicklaus Tunge, CFP®, CRPC®

On December 15th, a House and Senate Conference Committee released a unified version of the Tax Cuts and Jobs Act. The bill passed the House by a vote of 227 to 203 and the Senate by a vote of 51-48 on December 19th. President Trump could sign the bill into law very soon but will most likely wait until January (find out why here). The following provides a brief overview of the changes that will affect individuals and, more likely than not, become law.

PERSONAL INCOME TAX RATES

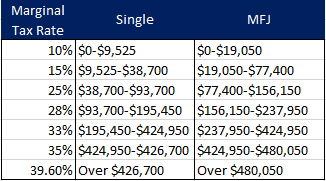

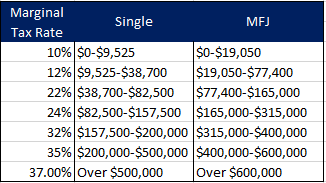

The number of tax brackets will remain at seven. The illustration below shows what the marginal tax rates would look like in 2018 under current law compared with the TCJA. Tax brackets will now be indexed to chained-CPI (C-CPI-U). This is meaningful because it may lead to lower inflation adjustments to the tax brackets.

2018 tax brackets under current law

2018 tax brackets under the TCJA

PERSONAL EXEMPTIONS

Personal exemptions are repealed. Currently, you can claim a $4,050 personal exemption for yourself, your spouse, and each dependent.

STANDARD DEDUCTION

The standard deduction will increase to $12,000 for individuals and $24,000 for married couples filing jointly. This compares to $6,500 for individuals and $13,000 for married couples filing jointly under current law. While the new standard deduction is higher, under current law individuals can claim a personal exemption plus the standard deduction. Therefore, there is actually only a small net increase in value for taxpayers. For example, an individual under current tax law can claim the standard deduction ($6,500) plus one exemption ($4,050) for a total deduction of $10,550, compared to $12,000 under the TCJA. A married couple filing jointly can claim the standard deduction ($13,000) plus two exemptions ($8,100) for a total of $21,200, compared to $24,000 under the TCJA.

MORTGAGE INTEREST DEDUCTION

Currently one can deduct qualifying mortgage interest for purchases up to $1 million plus an additional $100,000 for equity debt. Under the final bill, the mortgage interest deduction will be capped at $750,000. The deduction for interest on home equity debt will be eliminated beginning 2018. Both the $1 million mortgage interest cap and the home equity debt will return in 2026. It is worth noting that interest on a home equity loan or home equity line of credit could still qualify for a deduction if it will be used as “acquisition indebtedness” under IRC Section 163(h) and not “home equity indebtedness.”

STATE AND LOCAL INCOME TAX (SALT) DEDUCTIONS

State and local sales, income, and property tax deductions will remain in place but will be capped at $10,000. Under current tax law, if you itemize your deductions, you can deduct state and local income and property taxes. This is certainly a big blow to high-income tax states and individuals with large property taxes (e.g., East Grand Rapids).

MISCELLANEOUS ITEMIZED DEDUCTIONS

If you currently itemize your deductions, you may deduct those miscellaneous deductions (e.g., tax preparation expenses, unreimbursed employee expenses, home office expenses, etc.) that exceed 2% of adjusted gross income. These deductions will be eliminated under the final bill.

ROTH RE-CHARACTERIZATIONS

The “undo” button to recharacterize a Roth conversion back to a traditional IRA is repealed under the final bill. Currently, it is possible to convert money from a traditional IRA to a Roth IRA and have until October of the following year to recharacterize any portion of the conversion. Now, advisors will need to make sure they do enough due diligence to determine an accurate picture of a client’s income before year-end so they do not convert too much pre-tax money (i.e., bumping them into a higher tax bracket). Thankfully, this is already the approach I take with my clients.

ALIMONY TREATMENT

Under current law, alimony payments are deductible by the payor and reported as income by the payee. Beginning 2019, alimony payments would no longer be deductible by the payor, nor reportable as income by the recipient.

529 PLANS

Currently, earnings and distributions are free from federal tax if used for college tuition, room and board, fees, books, supplies or equipment. Under the final bill, 529 plan distributions can also be used for public, private and religious elementary and secondary schools, as well as homeschooled students (up to $10,000 per student per year) tax-free.

CAPITAL GAINS EXCLUSION FOR SALE OF PRIMARY RESIDENCE

Both House and Senate bills proposed to change the “two of five” rule to “five of eight.” However, under the final bill, there will be no change from the current law. This is a big win for the everyone!

FIFO ACCOUNTING

A very controversial rule that would have required investors to use the first-in-first-out (FIFO) accounting method is not included in the final bill. This is another huge win for everyone. Requiring investors to use FIFO accounting would have eliminated the ability to execute tax-loss harvesting and select specific tax lots to donate to charities.

ALTERNATIVE MINIMUM TAX

AMT will be repealed for corporations yet will remain for individuals. The exemptions will be increased to $70,300 for individuals and $109,400 for married couples filing jointly.

PEASE LIMITATION REPEALED

Those who have had AMT tax liability over the past few years will be happy to know that the Personal Exemption Phaseout (PEP) has been repealed, although it will return in 2026. What did the Pease limitation do? It essentially phased out 3% of a taxpayer’s itemized deductions once AGI hit $261,500 for individuals and $313,800 for married couples filing jointly, in 2017. Those taxpayers with income above that threshold lose some of the value of their itemized deductions.

CHILD TAX CREDIT

The Child Tax Credit is expanded from $1,000 per qualifying child to $2,000 per qualifying child. Thanks to U.S. Senator, Marco Rubio, $1,400 of that $2,000 is refundable.

CHARITABLE CONTRIBUTIONS

The deduction for cash donations to public charities is currently limited to 50% of AGI. Under the final bill, this is increased to 60%.

ESTATE AND GIFT TAX EXEMPTIONS

The unified estate and gift tax exemption amount will double from its current level of $5.6 million to $11.2 million for an individual or $22.4 million for married couples.

INDIVIDUAL MANDATE

The Individual Mandate that requires people to have healthcare coverage is repealed under the final bill but will not take effect until 2019.

DEFERRED COMPENSATION

Nonqualified deferred compensation (NQDC) plans will have a few changes coming. There are too many different types of NQDC plans to discuss during this post. If you are one of my clients who is an executive at one of the Fortune 1000 or Fortune 500 companies here in Michigan, expect to hear from your benefits department regarding any changes to your plan.

If you are one of my clients or someone who would like to discuss the tax changes in depth, and how you could be affected, please contact me.

Material in this publication is original or from published sources, and it is believed to be accurate. However, we do not guarantee the accuracy or timeliness of such information and assume no liability for any resulting damages. All expressions of opinion reflect the author’s judgment at the date of publication and are subject to change without notice in reaction to changing market conditions. The views expressed are those of the author and do not necessarily reflect those of Midwest Capital Advisors, LLC. This material is provided for general informational purposes only, and it is not to be construed as investment or financial advice or an offer, solicitation, recommendation or endorsement of any particular security, product or service. Readers are cautioned to consult their own tax and investment professionals with regard to their specific situations.